Joe Biden Endorses Warren Bankruptcy Policy As the number of days to the 2020 election dwindle down and primary results roll in, presidential candidates are refining their policies and campaigns. At a virtual townhall in Illinois in mid-March, former Vice President Joe Biden announced his endorsement of Elizabeth Warren’s bankruptcy policy. When the bankruptcy law […]

Author Archives: Kris Whelchel

Business Bankruptcies are on the rise in Minnesota Small businesses have begun to seek financial relief as the pandemic continues. From the federal to state level, programs have been enacted to provide assistance. These programs aim to help small businesses struggling to pay operational expenses due to COVID-19. Several of the programs are offering this […]

The affects of the Coronavirus (COVID-19) on Minnesota Unemployment & The Restaurant Industry Governor Walz has extended Minnesota’s Stay at Home Order through May 4th, also extending the closure of dine-in spaces and other entertainment venues. Restaurants, their employees, and the hospitality industry are facing unemployment and revenue loss. From systematic changes in filing for […]

All industries have been uniquely impacted by COVID-19 and its dramatic change to our everyday. Access to paid sick leave, the ability to work remotely and industry-wide shutdowns have affected different sectors of the workforce. According to MarketWatch, consumer-reliant industries will be the first to feel the hit of the new coronavirus strain. This classification […]

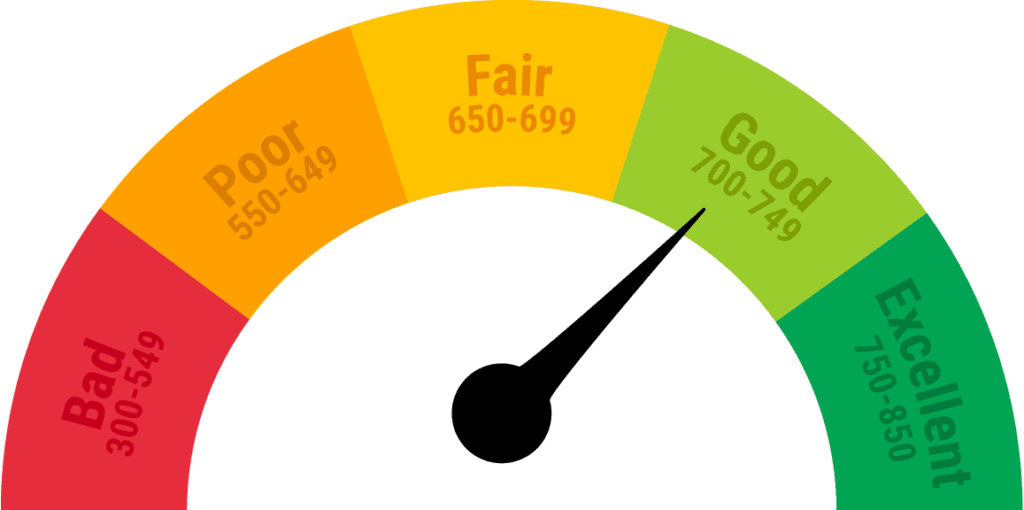

Minnesota is known for its lakes, dedication to the sport of hockey, and love of hotdish – but its residents’ financial responsibility is even more notable. For the eighth consecutive year, Minnesota residents held the highest average FICO credit score at 731 according to The Week. Following closely behind are South Dakota, Vermont, New Hampshire […]

Bankruptcy and Divorce. If you have been involved in a divorce, you may be wondering what happens to the debt that was divided in your divorce agreement. You may also wonder what happens if your ex files for bankruptcy. These answer depend on a few factors surrounding you and your ex.